Throughout the COVID outbreak, the processing component of the beef supply chain has presented a bottleneck in getting beef products to consumers. This is because, this is the segment of the supply chain that forces an abundance of labor to be in close quarters.

The recent Executive Order by President Trump to keep meat processing facilities open, provides some assurances of the beef supply chain remaining open. However, this also comes with future uncertainty regarding the ability of these plants to slow the spread of COVID-19 to its workers and surrounding community.

The present uncertainty around meat processing mostly impacts the value placed on cattle who will be ready for slaughter in the next couple months. In Montana, many ranchers are looking to the late fall months to sell their calves or feeder cattle. Nearly all of these animals are typically headed to stockers, backgrounders, and feedlots prior to slaughter.

We are likely to see continued adaptations at auction sales as a result of caution during auction along with an increasing ranching age demographic. Given the reduced processing, there is likely to be some expected bottlenecks that move back in the supply chain, until the meat processing can clear the market.

One question that always comes up in the spring (and producers are wondering now more than ever), is what can we expect for fall cattle prices? Within this context, there are two things to keep in mind when planning for fall sales.

Futures prices are expected to recover in the short run

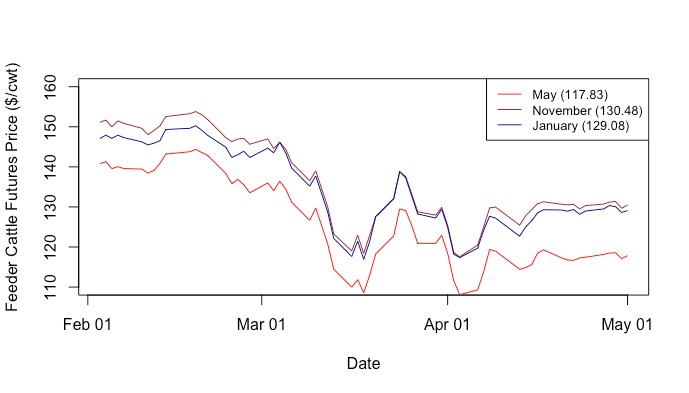

The figure below plots changes in the daily settlement prices for contracts due in May, November, and January. As of the settlement on Friday, May 8. All three of the price series indicates the negative impact on feeder cattle contracts and have fallen by around $15 per cwt. since early February. However, that includes a $10 rally that the market experienced this week.

This drop is the lowest monthly feeder cattle contracts have traded at since 2010. However, it is notable that the difference between prices has remained constant throughout the last few months. This indicates that those bottlenecks are likely not having an impact on feeder cattle prices, but the price drops are more related to short and potentially medium-term reductions in beef consumption away from home, as well as any anticipated recessionary expectations.

Implied volatility is extraordinarily high right now and above average for fall.

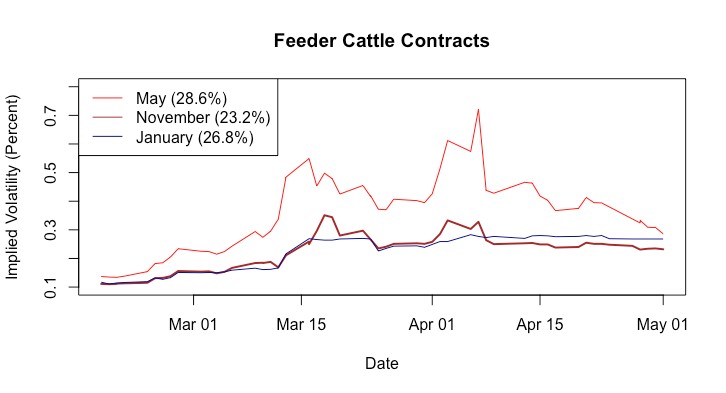

There is a lot of market uncertainty in the near term, particularly as it relates to the beef supply chain. That volatility is shown in the figure below as we see the increased implied volatility in May, diminishing slightly in the fall months. Implied volatility is one of the measures economists use to value the amount of uncertainty that is being priced into options contracts that are due in the future.

Normally, these series would be around 16% for feeder cattle. It should surprise nobody that uncertainty is high, but it is notable that this uncertainty shrinks substantially as we look into the fall contracts. The volatility between the three series has converged over the last couple weeks, which is promising. Volatility is expected to be elevated as the beef market tries to assess the severity and duration of the current market downturn. However, the convergence of these volatility measures indicates the short-term uncertainty is loosening, which may provide relief for those watching the markets to gauge what cattle prices will look like when it’s time to sell.

What does the market say about fall prices?

Marketing calves or feeder cattle in the fall has its advantages over marketing heavier animals currently. The market places a bit of a premium on waiting until that point and it appears that there is a little more certainty when making those contracts. That being said, volatile times are always a good time to consider risk management. With high volatility, options contracts are likely to be expensive for nearly every agricultural commodity.

Additionally, forward contracts take the risk of losing out on an improving market conditions. The silver lining is that once the beef supply chain has restored its normal functioning and restaurants continue to open up, it is likely that we will see a slow return to a market that looked more like December 2019 than April 2020. A slow return that may include some low prices until the economy picks back up again.

For 2019, CattleFax pegged the average 550 pound steer calf price at $164. It’s difficult to say where 2020’s prices will be. However, using today’s information, we can certainly estimate it. If a calf born this spring, sells the first of November and will finish against the August 2021 live cattle contract. With cheap corn, cost of gain should be relatively affordable.

BeefBasis.com uses current futures and regional basis at auction markets to estimate prices. As of this writing, it estimates 550 pound steers sold November 1st at Billings Livestock Commission to bring an expected cash price of $166.

That figure of course will change, but at least something to plan off of for making decisions for the year. And hopefully producers will see some financial assistance from the Coronavirus Food Assistance Program to help weather this storm.

###

MSU Ag Economics / Northern Ag Network

Find more market analysis at AgEconMT.com