Hard Red Winter Wheat Cash Price

| Ordinary Protein | 11% | 12% | |

| +11 Thu PM | +11 Thu PM | +11 Thu PM |

|

| South Central MT | 3.50 - 3.75 | 4.10 - 4.35 | 4.49 - 4.74 |

| Golden Triangle | 4.12 - 4.57 | 4.42 - 4.77 | 4.67 - 4.92 |

| Northeast MT | 3.35 - 4.15 | 3.65 - 4.35 | 3.90 - 4.50 |

| FOB Portland | +11 5.45 - 5.65 THu PM | +11 5.75 - 5.85 Thu PM | +11 6.00 Thu PM |

Dark Northern Spring Wheat Cash Prices

| 13% Protein | 14% | 15% | |

| Steady Thu PM | Steady Thu PM | Steady Thu PM |

|

| South Central MT | 5.27 - 5.71 | 5.49 - 5.95 | 5.67 - 6.11 |

| Golden Triangle | 5.52 - 5.70 | 5.92- 6.02 | 6.20 - 6.34 |

| Northeast MT | 4.91 - 5.32 | 5.27 - 5.72 | 5.51 - 6.12 |

| FOB Portland | Steady 6.69 - 6.81 Thu PM | Steady 6.97 Thu PM | Steady 7.05 - 7.09 Thu PM |

Wheat / Durum / Barley Cash Prices

| Soft White Wheat | Hard Amber Durum | Feed Barley | |

| Steady Thu PM | Steady Thu PM | Steady Thu PM |

|

| South Central MT | |||

| Golden Triangle | 6.35 | 3.72 | |

| Northeast MT | 6.50 - 6.70 | ||

| FOB Portland | 6.15 - 6.25 |

Wyoming / Nebraska / Colorado Cash Prices

| Hard Red Winter Wheat | Yellow Corn | Sorghum | |

| +8 to 11 Thu PM | Steady to +4 Thu PM | Steady Thu PM |

|

| S.E. WYO - S.W. NE | 4.14 - 4.35 | 3.84 - 4.16 | |

| North Central COLO | 4.55 - 5.15 | 4.44 - 4.49 | 3.04 |

| Northwest NE | 4.07 - 4.40 | 3.61 - 3.94 | 2.54 - 2.91 |

- Today’s Grain Market Update

Grain markets were lower again on Tuesday as traders are solely focused for the time being on good weather for the growing spring planted crops. It is also safe to…

Grain markets were lower again on Tuesday as traders are solely focused for the time being on good weather for the growing spring planted crops. It is also safe to…

- Trump Administration Announces Disaster Assistance for Farmers

U.S. Secretary of Agriculture Brooke L. Rollins announced today that agricultural producers who suffered eligible crop losses due to natural disasters in 2023 and 2024 can now apply for $16…

U.S. Secretary of Agriculture Brooke L. Rollins announced today that agricultural producers who suffered eligible crop losses due to natural disasters in 2023 and 2024 can now apply for $16… - Peterson Appointed Administrator of North Dakota Wheat Commission

The North Dakota Wheat Commission appointed Jim Peterson as Administrator of the Commission at its July 1, 2025 Board meeting. Peterson has been with the North Dakota Wheat Commission since…

The North Dakota Wheat Commission appointed Jim Peterson as Administrator of the Commission at its July 1, 2025 Board meeting. Peterson has been with the North Dakota Wheat Commission since… - Max Cederberg Reties from Montana Wheat & Barley Committee

Great Falls, MT – Max Cederberg of Turner, MT is completing his time with the Montana Wheat & Barley Committee (MWBC) following six years of service, but he’s also retiring…

Great Falls, MT – Max Cederberg of Turner, MT is completing his time with the Montana Wheat & Barley Committee (MWBC) following six years of service, but he’s also retiring… - Blake Wiedenheft Named Montana State University Endowed Chair in Plant Science

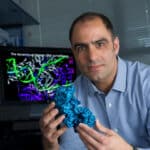

Blake Wiedenheft, a scientist in the Montana State University College of Agriculture, has been named the university’s next endowed chair in plant science. Wiedenheft will assume the position of Winifred…

Blake Wiedenheft, a scientist in the Montana State University College of Agriculture, has been named the university’s next endowed chair in plant science. Wiedenheft will assume the position of Winifred… - Weaker Dollar Helps U.S. Wheat Exports Surge

As the wheat marketing year for 2025/26 begins, a combination of a weaker dollar, more relaxed balance sheet, and timely moisture through much of the U.S. wheat growing area has…

As the wheat marketing year for 2025/26 begins, a combination of a weaker dollar, more relaxed balance sheet, and timely moisture through much of the U.S. wheat growing area has…