Wheat markets in recent years have been some of the most volatile in history. Global factors like war and drought have been major influences on trader mindsets leading to extreme and unpredictable price movement for wheat.

Marketing year 2022-2023 ended May 31st and U.S. Wheat Associates analyzed the information, providing an overview of the year’s export demand for U.S. wheat and demand trends.

US Exports, Specifically HRW Hurt by Market Conditions

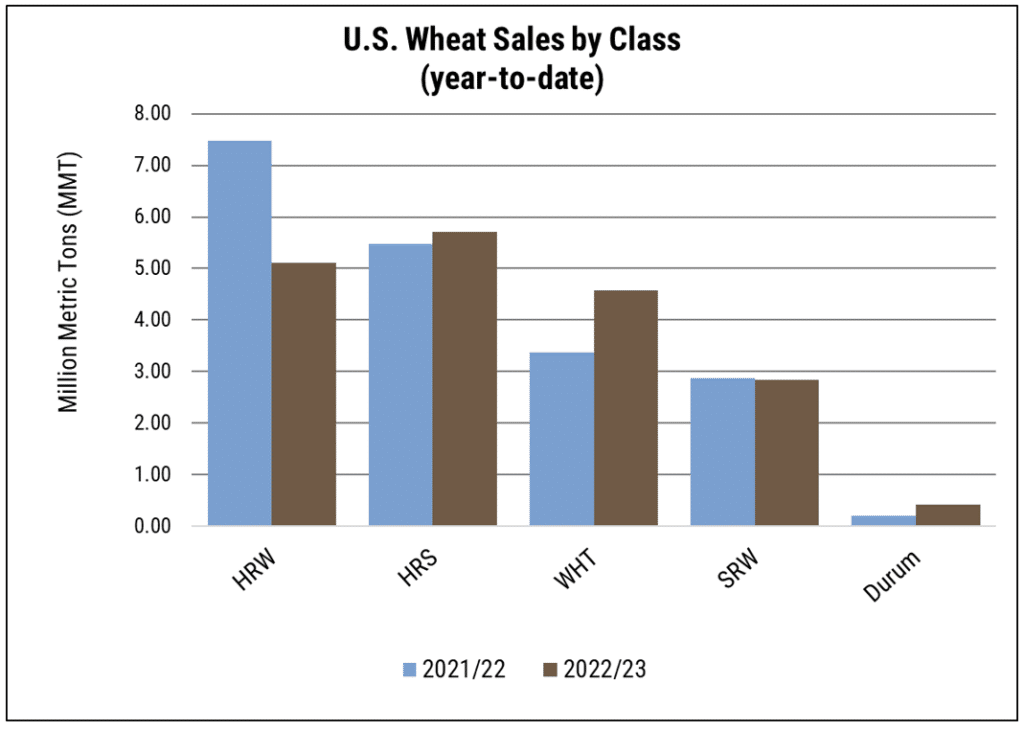

Hard red winter wheat sales were 32 percent behind the previous year because of high prices thanks to drought and war risks.

In an interview with the Northern Ag Network President of U.S. Wheat Associates Vince Peterson described some those market factors in greater detail.

“It was sort of a culmination year of problems, previously two consecutive years of drought in our winter wheat area, a record high crop in Australia, a very high crop of spring wheat in Canada and then the Russian war in the black sea in Ukraine just kind of turning the wheat market upside down on its head… all things we haven’t seen before. So, it was just sort of a combination of about three different things that came together and put us down about where we ended the year.”

Peterson said that drought-limited production leading to reduced supply meant that U.S. products were at a steep price premium compared to wheat from other countries for sale in the world market.

“…And our hard red winter wheat prices are the ones that probably caused us to suffer the most, we were as much as a hundred dollars a ton, even a little bit more on an FOB basis than Russian wheat or eastern European wheat, between the crop size and the price spread that really hurt the hard red winter wheat exports last year.”

Other classes of wheat exported from the U.S. fared better in world markets. Hard red spring sales were up 4 percent following drought in marketing year 2021-2022 that put exports at their lowest level since 2009. Soft red winter sales were nearly even with the year prior, white wheat exports were up 35 percent and Durum saw the largest increase by far, up 109 percent due to improved production and increased sales to Algeria and the European Union.

US Farmers Uniquely Suited to Meet High Quality World Demand

Despite some disappointing export data, Peterson is optimistic about opportunities for US farmers in world markets.

“With the research and development that’s going on, either from state university programs and plant breeding or even over in the private sector – quality targets are the most important thing, beyond yield and profitability, for farmers to be able to meet those market demands. We have what’s left in Latin America and Asia as the most demanding and sophisticated buyers that the world has.”

Peterson said that American farmers can produce high quality wheat to meet specific market demands around the world.

“Our task is to make our wheat a food ingredient and not just some bulk commodity and that’s how we’re going to succeed going forward. We’re not going to be the largest supplier, but we think we’re going to be the smartest and most efficient providing the best value to customers.”

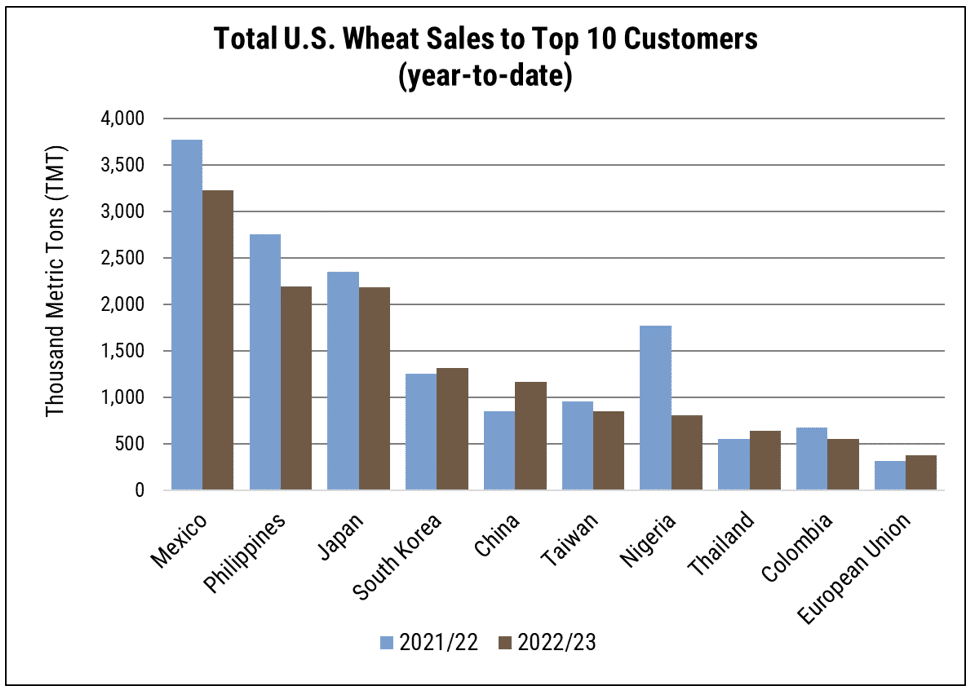

US wheat associates continues to work closely with buyers from Latin America and the Asia Pacific Rim to satisfy high quality wheat demand with American product. The top buyers of US wheat include Mexico, the Philippines, Japan, South Korea and Taiwan, which have been among the best customers for US wheat over the last 5 years. China also entered the market in a big way in early 2023, ultimately increasing its purchases by 38 percent.

Looking Ahead

So far in Marketing year 2023-2024, US all-wheat exports are down 18 percent from last year, however customers in Japan, South Korea and Taiwan are ahead of the previous year’s pace. U.S. Wheat Associates concludes that conditions right now are much more favorable to wheat importers, but risks from the war in Ukraine and weather patterns are still very present in markets.

###

US Wheat Associates, Northern Ag Network