As farmers gear up for 2023 harvest season, next year’s crop will likely be high on their minds. A Farm Futures August 2023 survey finds that growers are already thinking about strategies to be financially successful in the upcoming year and the results will have important implications for markets.

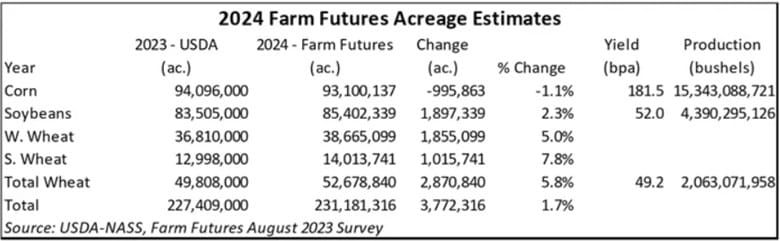

The Farm Futures survey, which garnered 985 farmer responses via email July 15 – August 1, found that farmers expect to plant 93.1 million acres of corn in 2024, down 1% from this year’s acreage. Shrinking revenue prospects amid relatively high costs will likely tighten profit margins for the 2024 crop, giving alternative crops more opportunity for acreage next spring.

Soybeans are one such crop farmers expect to expand in 2024. Surveyed farmers indicated a 2% increase in soybean acreage next spring to 85.4 million acres.

Wheat acres are also expected to expand, with winter wheat acres forecasted 5% higher at 38.7 million acres and spring wheat acres rising 8% to 52.7 million acres. It would be the largest wheat acreage planted since 2015.

If Farm Futures readers’ corn acreage expectations prove true, even though a smaller corn acreage will be planted, next year’s corn crop could still be the largest on record if weather patterns allow for a return to trendline yields. After several consecutive years of crop shortfalls and production challenges, the extra supplies could help revive liquidity in the corn demand pipeline.

That prospect is bearish for prices, as the large crop could flood the market and reduce the scarcity factor for U.S. corn in the upcoming year. Waning export demand and a shrinking cattle herd pose significant risks to corn usage prospects in the next 12 months.

If Farm Futures farmers’ intentions are realized, it is likely that wheat acreage expansion will be a segmented phenomenon and will depend heavily on weather conditions across the U.S. Plains. Even with a bigger winter wheat acreage expected, it will still be the ninth smallest winter wheat area sown.

Hard red winter wheat stocks are slated to end the current 2023/24 marketing year at 246 million bushels, as high prices and crop shortfalls have pushed many buyers out of that market. The past two marketing years have seen HRW stocks reach their tightest levels since 2013/14.

Similarly, another dry growing season along the Canadian border means that 2023/24 white wheat stocks are going to be pinched to their tightest level since China went on a white wheat buying spree during the 2020 pandemic. Plus, that same heat stress to current spring wheat crops in the northern U.S. could also keep supplies tight and acreage competitive in 2024.

If 2024 U.S. wheat acres are to expand, it will likely be a very segmented expansion. Barring any significant changes in Southern Hemisphere production, hard red winter and white wheat acres will continue to compete against alternative crop rotations in the Plains and Pacific Northwest this fall. Soft red winter wheat acres in the east will need catastrophic news from the Black Sea to remain price competitive in 2024 after a bumper harvest this summer.

###

Farm Futures