By Bernt Nelson AFBF Economist:

Cattle prices have come a long way in the first half of 2023. In fact, the weighted average market price for a steer this July is 27% higher than it was in July 2022. Drought and high input costs have driven many producers to market animals that would have been held back to grow their herds, and the resulting tighter cattle supplies are pushing retail beef prices to new highs. This Market Intel dives into the current supply and demand situation and provides an outlook on the second half of the year.

Supply – July 1 Cattle Inventory

The semiannual cattle inventory report is a record of all cattle and calves, number of operations, and size group estimates categorized by class, state and the country as a whole. The report is released in January and July. The July inventory uses information from the responses of 10,000 surveyed cattle operations. The more robust January survey is based on the responses of 50,000 operations.

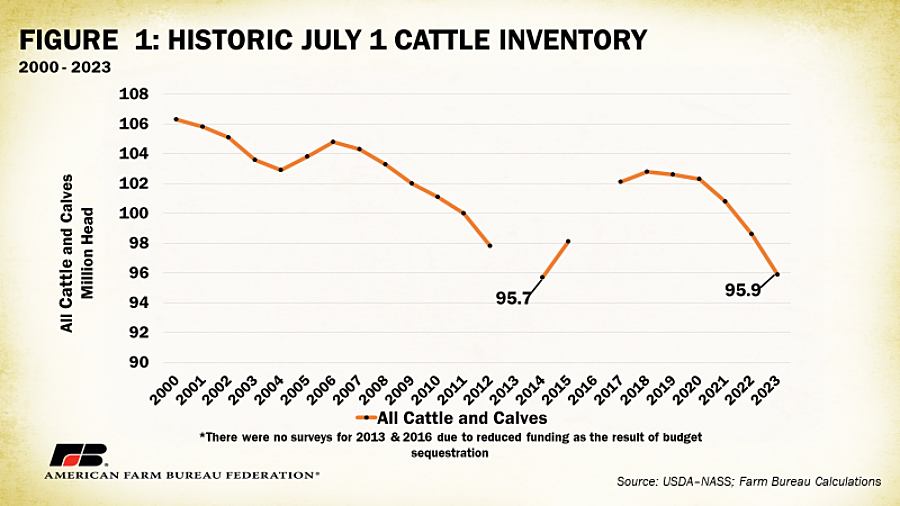

In the July report, USDA estimated all cattle and calves in the United States on July 1, 2023, were 95.9 million head, down 3% compared to last year’s report. This is a bigger decrease than average analyst expectations of -2.3% or 96.3 million head. This is only 200,000 greater than the 2014 inventory of 95.7 million (Figure 1). U.S. beef cattle were estimated at 29.4 million head, marking a 52-year low for beef cattle supplies. When inventory levels were this low in 2014, average 5-market area (Texas/Oklahoma/New Mexico; Kansas; Nebraska; Iowa/Minnesota) fed steer prices rose about 30% from July 2013 to July 2014. The July 2023 5-market average is currently $184.21/cwt, which is about 27% greater than 2022. This seems high but if we adjust for 28.88% inflation over the last decade, to be equivalent to the average price received in July 2014, the average cash price for fed steers would need to reach $203.51 per hundredweight

The calf crop is estimated at 33.8 million head, also down 2% from July 2022. USDA estimates 24.8 million calves were born during the first half of the year, with 9 million expected to be born during the second half of the year (fall calves).

Cattle On Feed

Also released on July 21, USDA’s monthly Cattle on Feed report estimates all cattle and calves on feed to be 11.2 million head on July 1, 2023, down 2% from July 2022. 11.2 million is slightly greater than the average analyst estimation, which was 2.4% fewer cattle on feed than last year or about 73,000 head below USDA estimates.

Placements of cattle into feedlots were a surprise at 1.68 million head. This was 3% above last year and well above the average analyst guess of 1.6 million or 2% below July 2022. While this is a bearish number in the short run, it is important to remember that increased placements mean farmers are not holding those cattle back to be used for replacement purposes, which will tighten supplies later.

Drought and Heifers on Feed

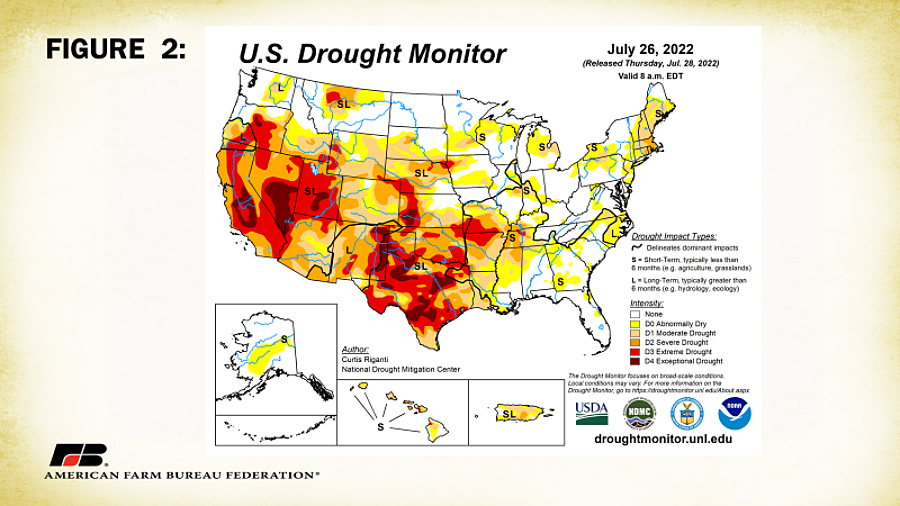

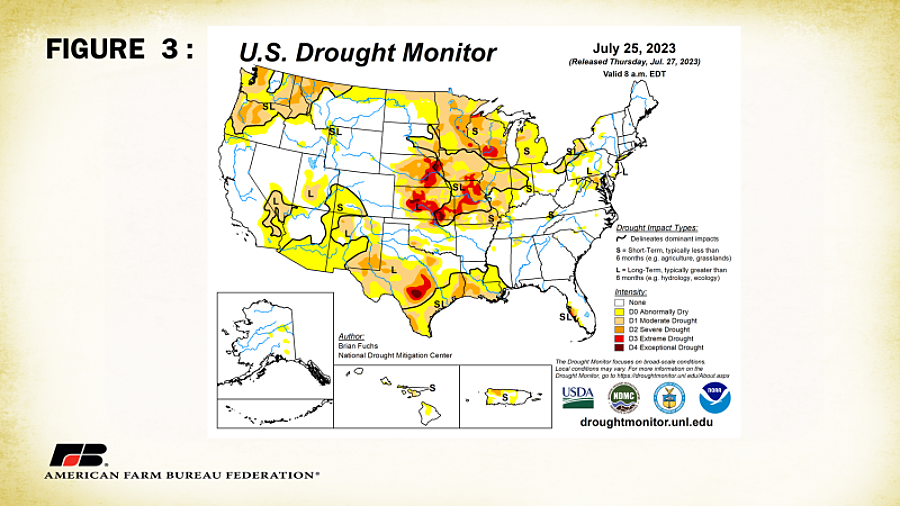

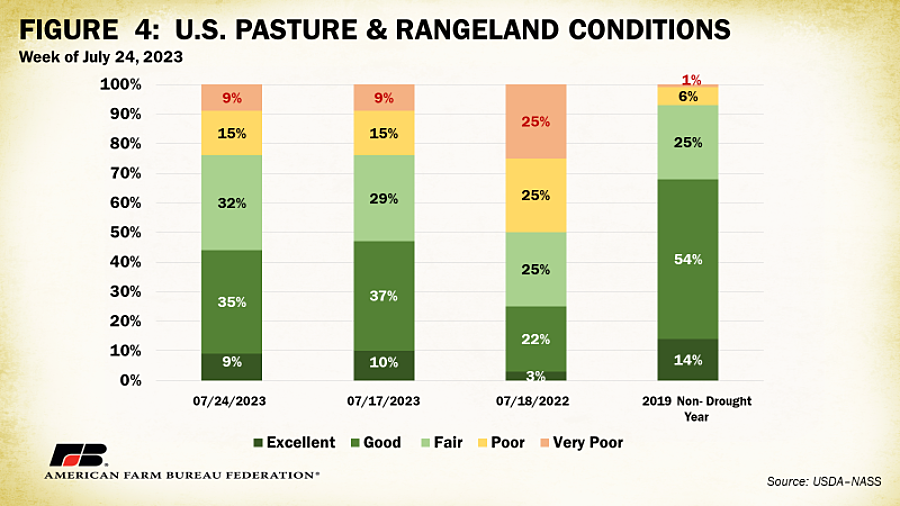

Last year there was a high proportion of cows and heifers being placed on feed due to ongoing drought conditions and elevated input costs (Figure 2). Cows and heifers that would normally be held back for breeding and placed on grass were placed on feed to market instead. While the U.S. has received rainfall to improve drought conditions in many of the affected areas, drought conditions remain, especially in the central Midwest (Figure 3). In its latest crop progress report, USDA estimates 44% of all pasture acres are in good to excellent condition. This indicates significant improvement over 2022 when just 22% of U.S. pastures were rated good to excellent (Figure 4).

These condition improvements combined with better calf prices are incentive for farmers to begin holding back cattle for breeding purposes rather than placing them on feed. According to USDA’s July Livestock, Dairy, and Poultry Outlook, slaughter cow numbers have dropped about 12% since July 2022. Examining this further, USDA left the number of heifers and heifer calves on feed unchanged from June in the July Cattle on Feed report. The fact that overall cattle and calves on feed is declining while the number of heifers and heifer calves on feed remains constant is evidence that some contraction is continuing in the industry and will continue at least through 2024. This is bullish news in the long run. Farmers will have to begin withholding heifers for replacements rather than placing them on feed for the overall cattle inventory to begin expanding again. When this happens, we can expect to see heifers on feed decline compared to overall cattle on feed.

Cattle Cycle

The declining cattle supply is a great example of how understanding the cattle cycle can be important when making marketing decisions. The cattle cycle is a term used to describe expansion and contraction in the cattle industry in response to perceived profitability over a period of time (typically around 10 years). The U.S. cattle industry has been in the contraction phase of the cattle cycle for about five years and these low inventory numbers and high prices typically occur before expansion in the industry begins. When expansion begins, cattle supplies will grow. A growing cattle supply will eventually mean a drop in prices.

Demand – Livestock Slaughter

Switching gears to demand, USDA’s monthly livestock slaughter report, released on July 20, contains information on meat production in commercial and federally inspected plants throughout the United States. The July report estimates red meat production was 4.55 billion pounds, down 5% from 4.73 billion pounds in June 2022. January to June 2023 red meat production was 27.3 billion pounds, down 2% from 2022.

Beef production was 2.33 billion pounds, down 5% from June 2022. This came from 23,500 head of cattle, also down 5% from last year. Dressed weights were down 1 pound from 2022, at 1,338 pounds. Accumulated beef production was down 4%. Declines in beef can be attributed to the smaller cattle inventory, more specifically beef cattle. Following the report, live cattle futures contracts rose to contract highs for all months with cash offerings being reported as high as $188/cwt.

Despite tighter cattle supplies and higher beef prices, domestic demand for beef has been strong. Per capita beef production is forecast at 58 pounds per person, down about 1.5% from 58.9 pounds in 2022. Overall U.S. demand for beef remains impressive considering the average price of all uncooked ground beef is at a record level of $4.86 per pound. Click here for more information on retail beef prices from USDA’s Economic Research Service.

Global Supply and Export Demand

USDA’s Foreign Agricultural Service’s most recent quarterly livestock poultry trade report, released on July 12, contains data for global trade, production, consumption and stocks and addresses global issues for livestock and meats. The report estimates global beef production for July 2023 is 59.6 million metric tons (mmt), up 1% from the April report. Drought conditions in other parts of the world, including Argentina and New Zealand, have caused herd liquidation, much like the U.S.. This will increase production in the short run in these countries, resulting in a slight increase in global production before declining cattle supplies cause production to slow.

U.S. beef export sales are currently running about 14% below year-ago levels. The biggest drop in sales is to Japan, falling 27.3 mmt, followed by South Korea with a decline of 24.3 million metric tons. Mexico and Canada have helped pick up some of that drop in sales. Beef export sales to Mexico are up about 16% or 5.3 million metric tons more than this time last year, while export sales to Canada are up about 11% or 2.6 mmt ahead of 2022 levels. There is still hope for improvements in U.S. beef exports. Export sales for muscle cuts for the week ending July 20 were huge at 21,400 metric tons. Periods of strong export sales like this are a sign of good global demand for U.S. beef, even though total export sales are still behind year-ago levels.

Summary and Conclusions

USDA released several reports in the last week that tell a story. Cattle inventory is continuing to decline. Beef cow (female beef cattle) slaughter numbers have begun to fall but heifers placed on feed are remaining steady while the overall number of cattle on feed is falling. Improving pasture conditions and better prices for calves are likely responsible for this change. Elevated placements of heifers on feed indicates that the contraction phase of the cattle cycle may continue through 2024. Demand has remained strong both globally and domestically. Tightening cattle supplies combined with continued demand are bullish signs for cattle and beef prices through the remainder of the year.

###

American Farm Bureau Federation