Despite challenging market factors, U.S. wheat exports for marketing year (MY) 2019/20, which ended May 31, totaled 988 million bushels, ahead of USDA’s export volume estimate of 970 million bushels. That’s 4 percent ahead of MY 2018/19 and 10 percent greater than the 5-year average of 897 million bushels.

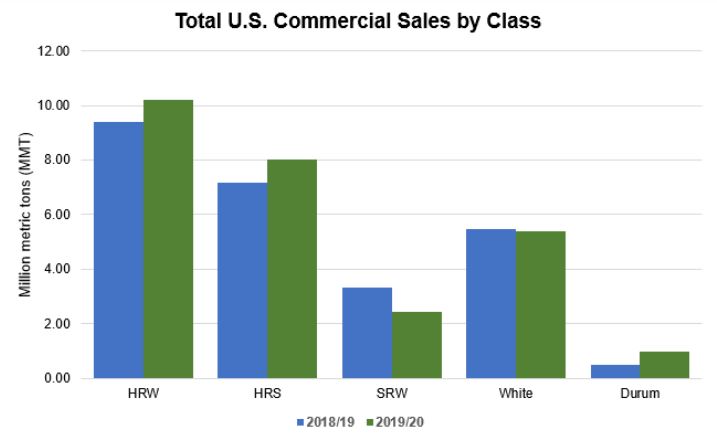

Commercial sales of all classes of wheat in MY 2019/20 exceeded 2018/19 levels in part from favorable market factors including abundant exportable supplies, strong harvest qualities, and competitive export prices at the beginning of the marketing year.

This offset such bearish factors as a strong U.S. dollar, competitor’s advantages, difficult winter wheat planting conditions, significant delays to the spring wheat and durum harvests, uncertainty about U.S. trade policies, and recent challenges during the COVID-19 pandemic.

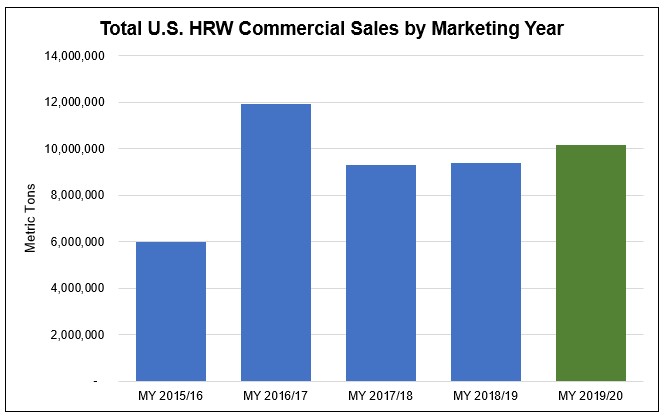

Hard Red Winter

Significantly greater production and attractive export prices buoyed hard red winter (HRW) exports year-over-year. Total 2019/20 HRW exports came in at 375 million bushels, 9 percent ahead of last year. According to USDA, higher yields due to cool, moist conditions during the 2019 growing season more than offset decreased planted area. HRW production increased 26 percent in 2019/20 to 834 million bushels. Increased exports to Mexico, the largest market for HRW, Taiwan, Indonesia, Brazil and Colombia more than offset reduced exports to Nigeria, Japan, Iraq and Egypt. Sales to Mexico totaled 95.9 million bushels, the highest on record and 22 percent more than last year. HRW sales to China picked up in 2019/20 to 11.1 million bushels compared to the zero bushels sold in 2018/19.

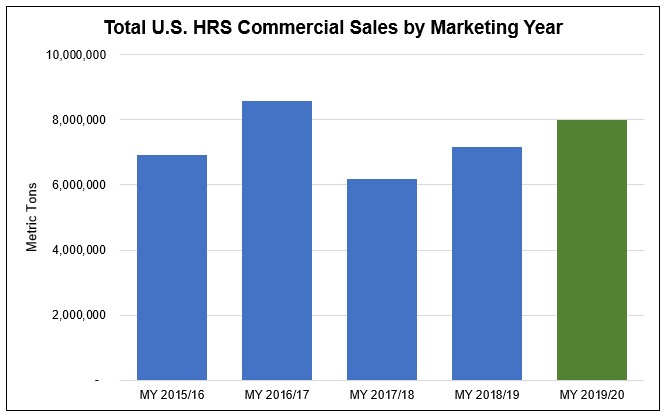

Hard Red Spring

Total hard red spring (HRS) commercial sales of 294 million bushels were 12 percent greater than last year and 36 percent greater than the 5-year average of 53.3 million bushels. Exportable supplies were relatively stable year-over-year as higher beginning stocks in 2019/20 cushioned reduced production. Commercial sales to the Philippines, Japan, Taiwan, South Korea and Vietnam, the top five export markets for HRS, all outpaced 2018/19 sales. HRS sales to China for delivery in 2019/20 at 5.36 million bushels were more than 4 times greater than the quantity sold for delivery in 2018/19.

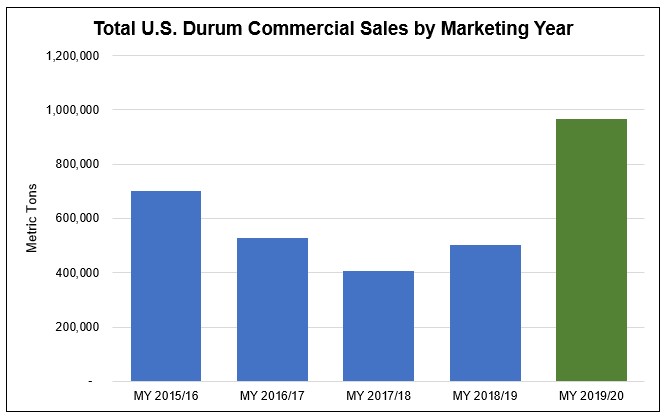

Durum

USDA reported 2019/20 durum sales at 35.5 million bushels, nearly double last year’s figure and 70 percent greater than the 5-year average on significantly increased European Union (EU) imports. EU durum production fell 14 percent year-over-year on sharply lower harvested area, prompting greater imports from the United States. Italian imports of U.S. durum nearly tripled last year’s import volume at 24.7 million bushels.

###

U.S. Wheat Associates