This fall, Representative Trent Kelly (R-MS-01) presented the Farmer Assistance and Revenue Mitigation Act of 2024 (FARM Act) and was co-sponsored by 48 other representatives from both sides of the isle. This bill would provide economic assistance to offset producer costs with the lack of a Farm Bill.

Producers would be paid on actual planted acres for crop year 2024 plus 50% of all acres that were not planted. All payments will be made based on USDA projected costs and returns.

The following crops would be eligible for assistance: barley, corn, cotton, dry peas, grain sorghum, lentils, large chickpeas, oats, peanuts, rice, small chickpeas, soybeans, other oilseeds, and wheat. FARM Act payments are calculated as follows:

FARM Act Payment = (Projected Cost – Projected Returns) x Eligible Acres x 60% where:

- Projected Cost is the per-acre cost published by USDA’s Economic Research Service for corn, soybeans, wheat, cotton, rice, sorghum, oats, and barley and otherwise as determined by the Secretary in a similar manner.

- Projected Returns for corn, soybeans, wheat, cotton, rice, sorghum, oats, and barley are determined by multiplying the projected 2024 marketing year average price published in the WASDE by the 10-year national average yield for the eligible commodity and otherwise as determined by the Secretary.

- Eligible Acres consist of 100% of the acres planted to an eligible commodity plus 50% of the acres prevented from being planted to an eligible commodity in crop year 2024, as reported to FSA by the producer.

Existing provisions relative to attribution of payments, actively engaged in farming, and other regulations apply. With respect to payment limitations, persons or entities that derive less than 75% of their income from farming, ranching, or forestry are subject to an overall limitation of $175,000. Persons or entities that derive 75% or more of their income from farming, ranching, or forestry are subject to an overall limitation of $350,000 in assistance.

The National Association of Wheat Growers along with many other commodity groups support this bill. “Producers across the country continue to be hit hard by natural disasters, higher input costs, and low reference prices. As we wait for a new farm bill to be signed into law, farmers need assistance as we deal with external factors out of our control. The FARM Act is not a replacement for a long-term farm bill but provides farmers with the tools we need to keep our operations running,” said Keeff Felty, President of the National Association of Wheat Growers.

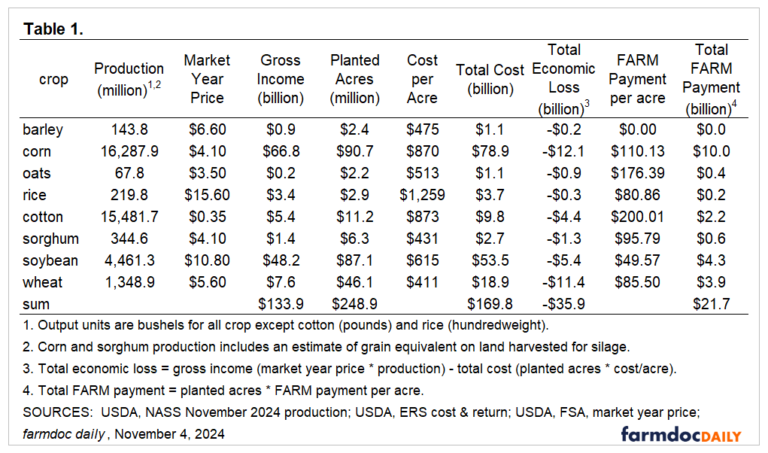

The University of Illinois estimated economic loss for 2024 production of the eight crops totals -$35.9 billion (see Table 1). Each crop has an economic loss, ranging from -$12.1 billion for corn and -$11.4 billion for wheat to -$0.3 billion for rice and -$0.2 billion for barley.

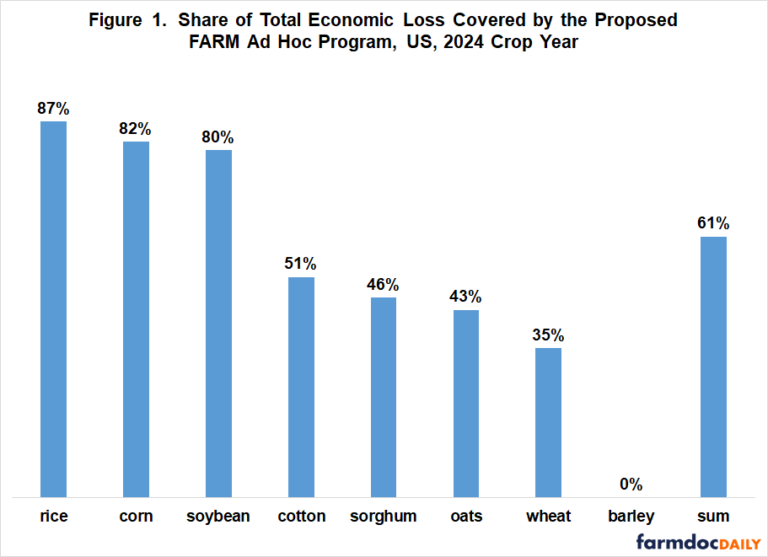

Estimated payments by FARM cover $21.7 billion or 61% of the $35.9 billion of total economic loss incurred from producing in 2024 the eight crops listed in Table 1. Share of the estimated loss covered by the estimated FARM payments by crop ranges from 87% (rice) to 0% (barley). Coverage is 82% for corn and 80% for soybeans. For the remaining four crops, coverage ranges from 51% for cotton to 35% for wheat.

The large variation in FARM coverage of economic loss across crops prompts the “fairness question,” especially since most farmers plant multiple crops and the rationale for FARM assistance is a decline in US market-wide revenue and prices from recent levels while production costs remain high.

###

NAWG/University of Illinois/Southern Ag Today