USDA currently estimates the United States will export 26.5 million metric tons (MMT) of wheat in 2020/21, 1% ahead of last year’s pace, if realized. Five months into marketing year (MY) 2020/21, total U.S. wheat commercial sales are 12% ahead of last year’s pace at 16.8 MMT and are 15% ahead of the 5-year average.

To date, export sales of hard red winter (HRW), hard red spring (HRS) and white wheat (soft and hard) are significantly ahead of last year’s pace. Sales of soft red winter (SRW) and durum lag 2019/20. Success in individual markets such as China and Brazil due to policy changes and follow-on trade and technical service by U.S. Wheat Associates (USW) are supporting overall sales. As in other markets, competitive pricing for U.S. wheat early in MY 2020/21 helped fuel a faster import pace even by traditionally strong U.S. wheat buyers like the Philippines and South Korea.

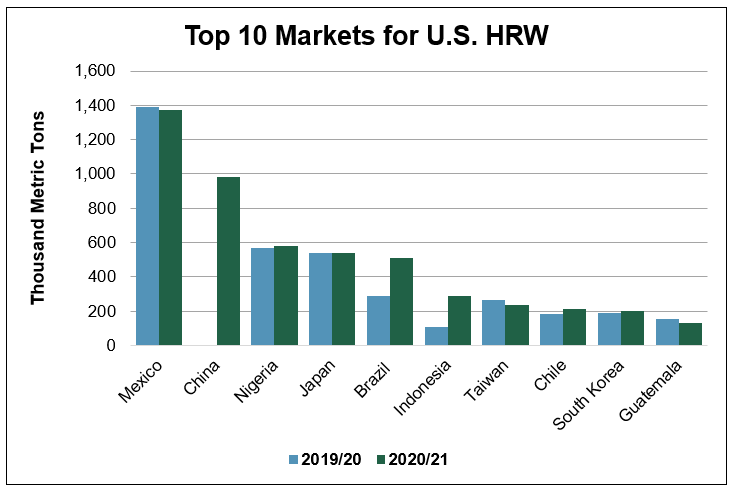

HRW. Total HRW sales are 12% ahead of last year at 6.12 MMT. Stable exports to Mexico, Nigeria and Japan, the top three markets for HRW, and significantly stronger export programs to China and Brazil are supporting HRW sales in the first third of MY 2020/21.

As of October 29, China has purchased 981,000 metric tons (MT) of HRW after no purchases in 2019/20. Strong HRW export sales so far in 2020/21 can be attributed to the Phase One agreement between the United States and China, as well as competitive HRW prices early in the marketing year. So far in MY 2020/21, China is the second largest market for HRW behind Mexico.

HRW export sales to Brazil are nearly two times more than this time last year at 513,000 MT and are 49% ahead of the 5-year average. According to the USW Regional Director for South America, the opportunity to advance sales to Brazil came with the Brazilian government opening a tariff rate quota (TRQ) allowing up to 750,000 MT of non-Mercosur (South America’s free trade bloc) wheat to enter the country tariff-free. Strong USW educational programs in Brazil are encouraging millers to take advantage of the high quality and competitive prices of U.S. wheat. To date, Brazil is the fifth largest market for HRW.

Source: USDA FAS export sales data as of Oct. 29, 2020

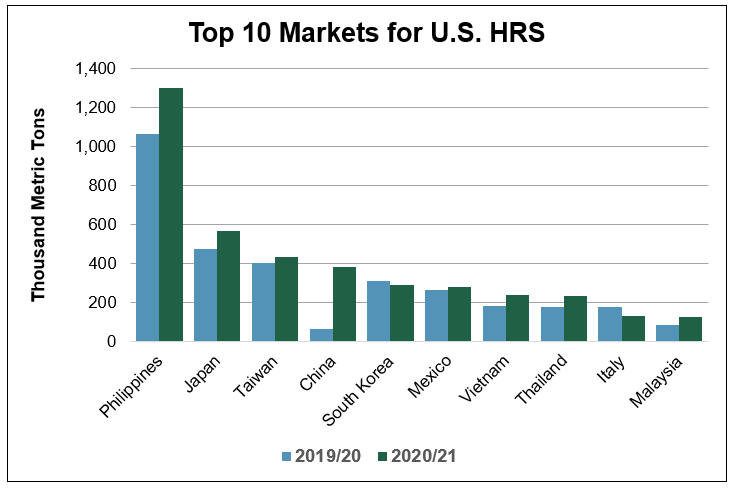

HRS. Total HRS export sales of 4.72 MMT are 15% ahead of this time last year and are 8% ahead of the 5-year average. Sales to the Philippines, the top market for HRS, are 22 percent ahead of last year at 1.30 MMT and are 34% ahead of the 5-year average. Rising per capita consumption combined with population growth and competitive HRS prices early in the marketing year supported strong sales to the Philippines at the start of 2020/21.

In Japan, the second largest market for HRS, sales of 569,000 MT are up 20% on the year.

“We had good start this year in the Japanese market following the U.S. and Japan trade agreement implemented on January 1,” said Rick Nakano, USW Country Director, Japan. “This gives U.S. wheat a better opportunity to be traded on equal footing with similar classes of wheat from Canada. This results is a great outcome for U.S. wheat to compete equally again with Canadian wheat to meet the needs of Japan’s flour millers.”

Source: USDA FAS export sales data as of Oct. 29, 2020

White. Total U.S. white wheat sales are 41% ahead of this time in 2019/20 at 4.02 MMT and are 36% ahead of the 5-year average. In the Philippines, the largest market for U.S. soft white wheat, export sales are up 42% on the year and are 40 percent ahead of the 5-year average.

The increased demand by Philippine millers is partially due to early customer buying in response to tight export elevation capacity in the Pacific Northwest (PNW). Strong USW educational programs in the Philippines helped customers stay informed and make timely buying decisions in the first third of MY 2020/21.

Sales to South Korea, the second largest market for U.S. soft white wheat, are 79% ahead of last year’s pace and are 53% ahead of the 5-year average. Soft white wheat on a C&F (FOB and freight) landed basis to South Korea has been priced very competitively.

Looking ahead, Australia’s larger 2020 crop is coming to market and its prices are coming down. USDA predicts the 2020/21 Australian wheat crop will reach 28.5 MMT this year, 87% ahead of last year as beneficial rains pull the country out of a three-year drought.

SRW export sales are a different story. Total SRW export sales are down 26% on the year at 1.36 MMT, 21% behind the 5-year average. SRW export sales to all of the country’s top 10 overseas markets are behind last year’s pace.

Between early June and late October, the average export price for SRW was $233/MT, 12% higher than the same period last year. Limited exportable supplies of SRW along the Mississippi River due to lower planted area in key states and extremely tight export elevation capacity in the Center Gulf due to increased export demand for soybeans and corn continue to support SRW export prices early in MY 2020/21.

Durum. Year-to-date durum sales in 2020/21 are 19%t behind last year’s pace at 541,000 MT but are 30% ahead of the 5-year average. Total sales to Italy, the largest market for U.S. durum, are only 3% behind last year’s pace, but are 66% ahead of the 5-year average.

###

U.S. Wheat Associates

Claire Hutchins – USW Market Analyst

Northern Ag Network