The Montana Stockgrowers Association (MSGA) filed an amicus brief alongside the Wyoming Stockgrowers Association (WSGA) and Wyoming Wool Growers Association (WWGA) to the United States Supreme Court in a crucial corner crossing case.

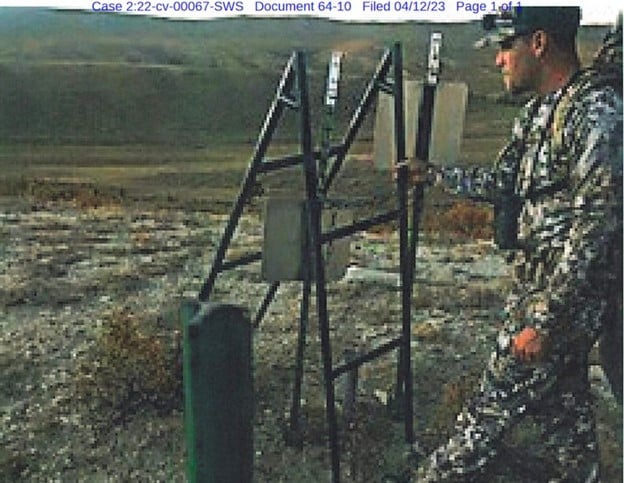

The original litigation centered around four hunters who accessed checkerboarded public land via a ladder over the corner of private property. The landowner, the plaintiff, sought to uphold the long-established principal in Wyoming that considered corner crossing to be a trespass. However, in March 2025, the Tenth Circuit Court of Appeals upheld the right to corner cross to access federal public lands as long as a private landowner’s land is not physically touched. The plaintiffs, the landowner, have since filed a petition for the case to be elevated to the U.S. Supreme Court.

The filed amicus brief provides a compelling argument from a landowners perspective for the court to take up the case and highlights the importance of a property owner’s right to protect their airspace, and land, from trespass.

“Corner crossing is a serious threat to the integrity of private landownership, undermines long-standing property boundaries, and may set a harmful precedent that erodes the ability of landowners to manage and protect their property,” explained Raylee Honeycutt, MSGA Executive Vice President. “MSGA has a long history of advocating for clear, consistent laws that uphold the rights of landowners while supporting access solutions that respect both public and private interests.”

WSGA Executive Vice President Jim Magagna noted, “Wyoming Stock Growers has been engaged in this litigation since the case was initially filed in Federal District Court. It has been our position that private property rights are appropriately under the jurisdiction of the state. Today, we are urging the Supreme Court to take up this case to provide a definitive answer to the trespass issue and to assure conformity in the law across the West. We are appreciative of the Wyoming Wool Growers and the Montana Stockgrowers joining us in this effort.”

“The Wyoming Wool Growers have been engaged in the corner crossing case since shortly after the case began. We are happy to support the WSGA and MSGA and come together to preserve private property rights in the West, shared Alison R. Crane, Ph.D., Executive Director of Wyoming Wool Growers Association.

MSGA, WSGA, and WWGA have defended private property rights for more than a century and will remain engaged in supporting movements toward affirming those protections.

###

MSGA

Wonderful, ranchers are an endangered species. Thanks

Property taxes should be assessed for the additional property valuation claimed by Mr. Eshelman due to restricting public access to public land. This valuation is unrelated to Ag and would be a welcome additional payment.

It’s refreshing to see agriculture and wealthy land owners communicate their true intentions- restricting access to public lands to increase their land values and personal wealth- tax free by limiting corner-crossing. Agriculture, stock growers and wealthy individuals shielding wealth (wannabe ranchers), enjoy large government subsidies from local, state and federal programs and the excessive use of public resources (land and water). ON TOP OF THIS THEY WANT MORE! SO UNFAIR.

Agricultural land is taxed the at lowest property tax rate in western states, ONE OF MANY SUBSIDIES. This assumes a land valuation for AGRICULTURE use. Mr. Eshelman, MSGA, WWGA, WSGA and others want to protect their increased land value resulting from restricting access to public land while enjoying the private benefit and value of public-land in-holdings. Mr. Eshelman clarifies, via his lawsuit, that this NON-AGRICULTURAL value-add for his land is $9M and similar NON-AGRICULTURAL value in the western states reaches into the BILLIONS. This property valuation is entirely unrelated to agricultural operations and should be taxed for the benefit of public (WHO IS BEING ROBBED BLIND DUE TO THEIR INCREASED PROPERTY TAXES). Citizens of Montana, Wyoming and other western states would welcome increased property tax revenue from modern-day robber barons. Using Eshelman’s $9M non-agricultural value addition and using Montana’s 1.9% taxable property tax rate on second homes could create an additional $171,000 in taxable value. Extending this to billions of dollars in property valuation equates to $19M per $1B lost annually from western state citizens who ultimately pay to allow the ultra-wealthy to restrict access to the land owned by the general public. Citizens could and should argue that taxation on this increased property valuation (gained by restricting public access to land) SHOULD BE MUCH HIGHER!!